Tax Accountant In Vancouver, Bc - Questions

Wiki Article

The 6-Minute Rule for Outsourced Cfo Services

Table of ContentsThe Main Principles Of Virtual Cfo In Vancouver The Greatest Guide To Vancouver Accounting FirmTax Consultant Vancouver Things To Know Before You BuyA Biased View of Tax Accountant In Vancouver, BcIndicators on Cfo Company Vancouver You Should KnowSmall Business Accounting Service In Vancouver for Beginners

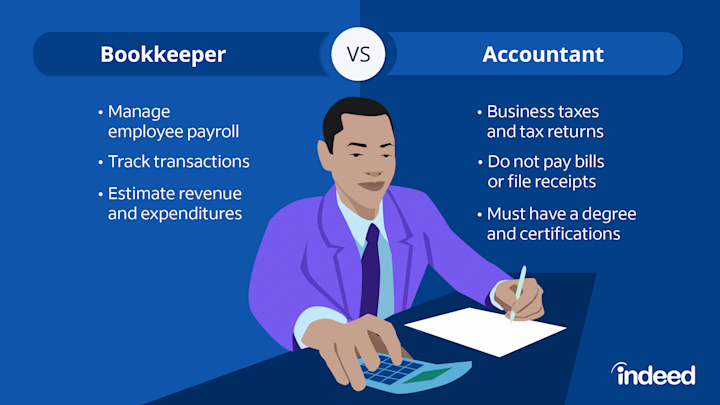

Right here are some benefits to working with an accounting professional over an accountant: An accountant can provide you a comprehensive view of your organization's monetary state, together with techniques as well as suggestions for making financial choices. On the other hand, bookkeepers are just accountable for recording financial transactions. Accountants are called for to complete even more education, accreditations and also job experience than accountants.

It can be difficult to gauge the ideal time to employ an audit expert or accountant or to establish if you require one whatsoever. While lots of small businesses hire an accounting professional as a professional, you have numerous choices for managing economic jobs. As an example, some small company proprietors do their very own bookkeeping on software application their accounting professional recommends or makes use of, providing it to the accounting professional on an once a week, monthly or quarterly basis for activity.

It may take some background research to find an appropriate accountant since, unlike accounting professionals, they are not required to hold a professional accreditation. A strong recommendation from a trusted coworker or years of experience are vital factors when working with a bookkeeper.

The Best Guide To Virtual Cfo In Vancouver

For local business, proficient cash money administration is an important aspect of survival as well as development, so it's important to deal with a financial professional from the beginning. If you favor to go it alone, think about starting out with bookkeeping software as well as maintaining your books diligently up to day. That way, ought to you require to employ a specialist down the line, they will certainly have exposure right into the full monetary history of your organization.

Some resource meetings were performed for a previous version of this short article.

Outsourced Cfo Services Fundamentals Explained

When it concerns the ins as well as outs of taxes, bookkeeping and money, nonetheless, it never ever hurts to have a knowledgeable professional to transform to for advice. A growing variety of accounting professionals are likewise dealing with points such as capital forecasts, invoicing and also HR. Eventually, numerous of them are taking on CFO-like functions.Small company owners can anticipate their accounting professionals to aid with: Choosing business structure that's right for you is necessary. It affects just how much you pay in taxes, the paperwork you require to file as well as your personal obligation. If you're seeking to convert to a various business framework, it could result in tax obligation consequences as well as various other complications.

Also firms that are the very same pop over to this site size and also industry pay very various amounts for accounting. These prices do not convert into cash money, they are needed for running your organization.

Indicators on Cfo Company Vancouver You Should Know

The ordinary expense of audit solutions for little company differs for each distinct scenario. The typical regular monthly bookkeeping charges for a little organization will certainly rise as you add more solutions and the tasks get tougher.You can tape deals and also process pay-roll making use of on the internet software program. You enter amounts right into the investigate this site software program, as well as the program computes totals for you. In some instances, payroll software for accounting professionals allows your accountant to offer pay-roll handling for you at really little extra expense. Software application services are available in all shapes and dimensions.

What Does Small Business Accountant Vancouver Do?

If you're a brand-new company owner, don't fail to remember to element audit costs into your budget plan. Management costs as well as accounting professional costs aren't the only accountancy expenditures.Your time is also useful and also must be considered when looking at bookkeeping prices. The time invested on bookkeeping jobs does go to this website not create earnings.

This is not planned as legal advice; for more info, please go here..

Everything about Tax Consultant Vancouver

Report this wiki page